The Best ofIntima & Swim Edit

The Best of Intima brings you its annual North American survey based on interviews to 200 specialty stores nominated for the Best of Intima Awards throughout the years revealing how their boutique performed in the 12 months behind us and what’s in store as they look ahead.

Through our panel of interviewees, we look individually at the USA and Canada so as to provide a more specific picture of the results including which brands sold best in each country. This work is fundamental to the understanding of this specific market, enabling us to assess the sell-out brands and monitor the development of styles in general across the continent as well as taking the pulse of buying patterns for the year ahead. It is also an opportunity to congratulate the brands that win first place by product category and which will be eligible to the Best Brand Awards plaque.

USA

With elections looming at the end of the year and ongoing economic uncertainty, retailers anticipated that customers would be more cautious with their spending. However, 2024 has generally been viewed as a positive year for sales, with fashion gaining traction among American consumers and equaling price sensitivity as a key priority. Social media storytelling, exceptional customer service, and strategic product diversification (or, in some cases, prioritization) have been the key tools boutiques have leveraged to maintain healthy margins.

OVERVIEW

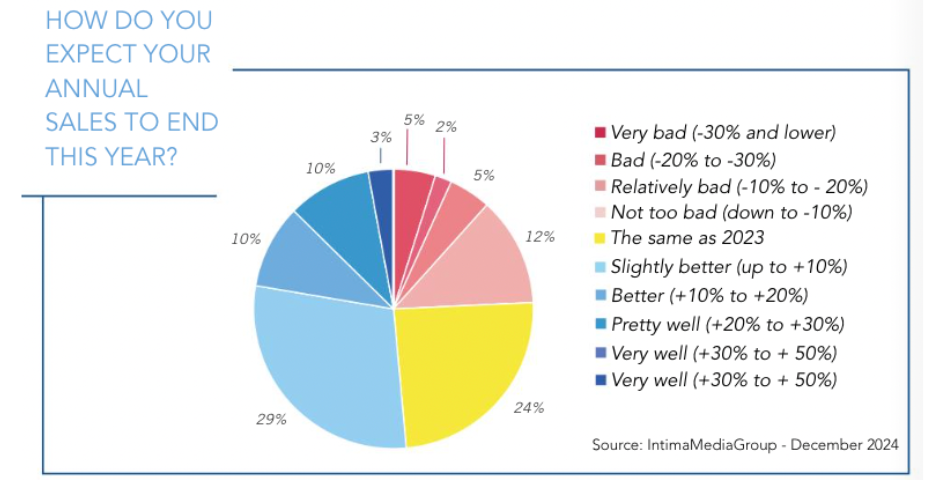

A combined 51% of stores interviewed stated they would be closing their year with better results than 2023 (up from 45% the year before), with 13% registering an increase exceeding 20%, an encouraging sign. A further 24% stated sales would be finishing on a par with 2023 and a combined 24% predicted a loss in sales (although mainly around - 10%). May and June appear to be the most successful months for many, while October and November were especially mentioned as being slow due to the upcoming election uncertainty. Hurricanes, intense bad weather and a continued rise in inflation were also indicated as causes of losses as well as numerous boutiques suffering from road works preventing foot traffic.

WHAT SOLD BEST

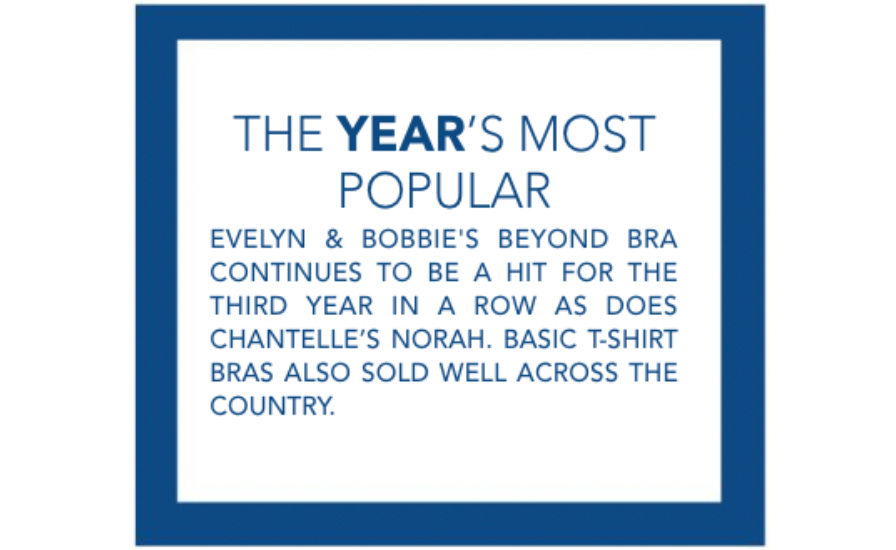

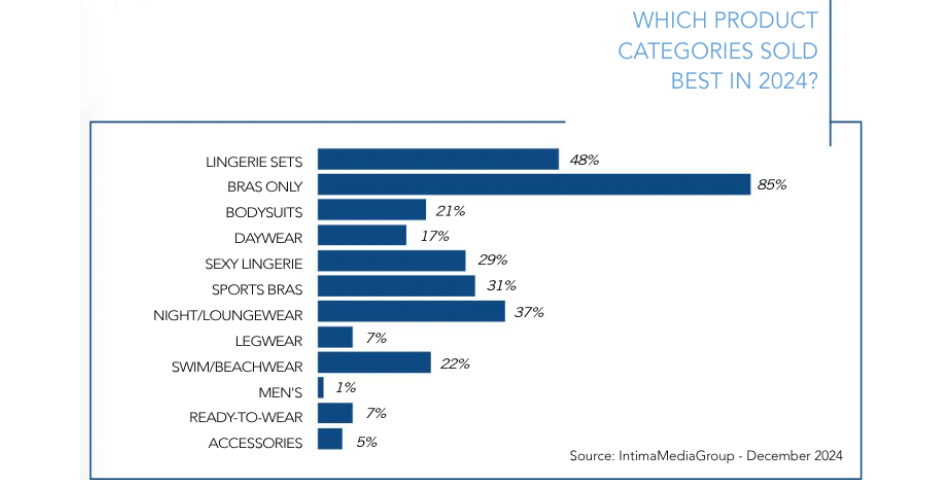

BRAS again reign supreme at US lingerie stores, topping the charts at 85%, with LINGERIE SETS in second position with 48%. NIGHT/LOUNGEWEAR makes a comeback in third, following a decrease we had witnessed over the past two years, despite numerous stores mentioning they expected better. SPORTS BRAS in fourth overtook SEXY LINGERIE which was down 7 percentage points in 2024. Overall SWIM/BEACHWEAR saw a slight positive impulse, although a number of boutiques mentioned their sales were quite disappointing. Bodywear easy-to-wear categories are up, with BODYSUITS, DAYWEAR and LEGWEAR totalling 47% . ACCESSORIES (5%) and MEN’S (1%) reflect previous year trends. Across the panel it was mentioned that customers are still hesitant to invest in good quality maternity bras.

CUSTOMERS MAIN PRIORITIES

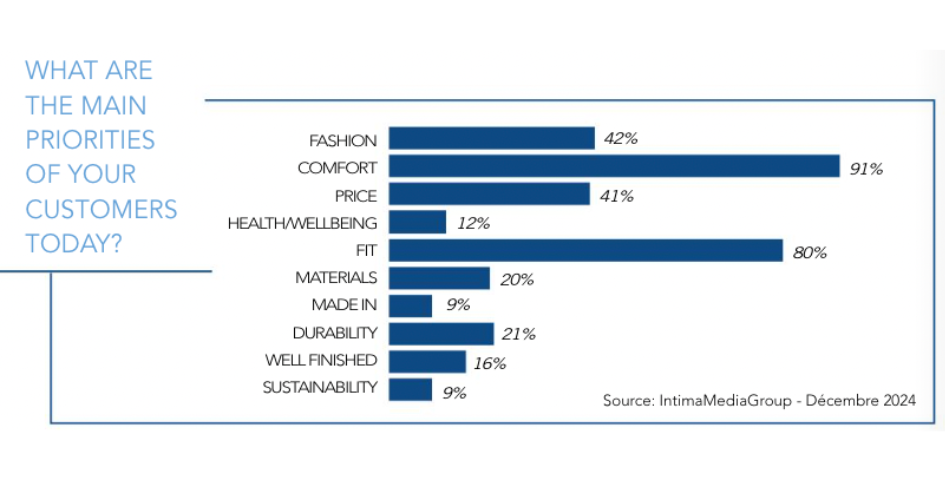

When it comes to priorities in purchasing intimate apparel COMFORT and FIT continue to be the leading criteria clients are looking for. The surprise for 2024 is FASHION in third position, having caught up with PRICE. DURABILITY and MATERIALS come next (similar to 2023). WELL FINISHED is stable compared to last year, while HEALTH/ WELLBEING, MADE IN and SUSTAINABILITY remain the three bottom criteria driving customer purchases. Boutiques continue to lament the lack of cotton basics which customers are requesting, as well as the need for larger bands and wire free larger cup bras.

2025 PERSPECTIVE

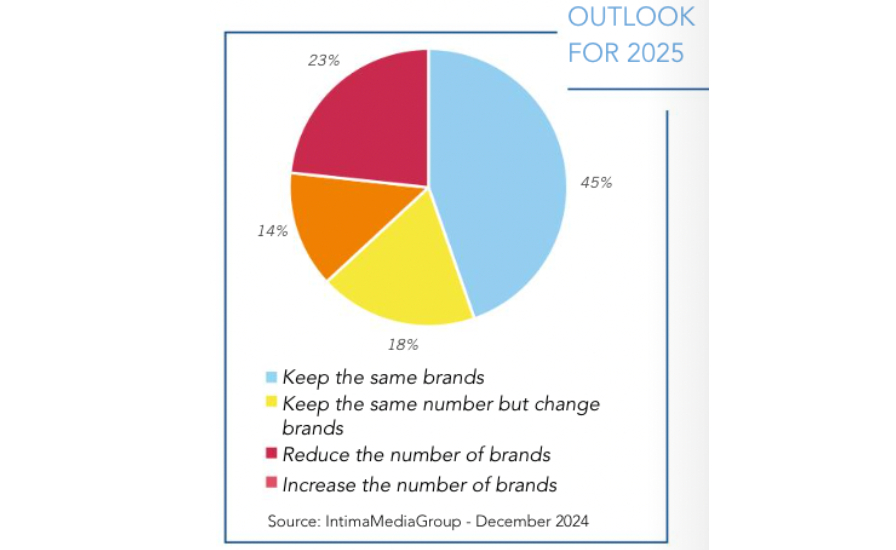

For 2025 45% of the interviewees will be keeping the same brands (up from 42% last year) and 23% will be increasing the number of brands (slightly down from 26%). 18% will be keeping the same number but changing brands and 14% will be reducing the number of brands. A consistent number of interviews said they were thinking of bringing in or bringing back swimwear and an increasing interest in mastectomy lines was voiced. Looking ahead, across the panel there was uncertainty as to how to contrast increases in prices.

Copyright 2025. All right reserved - Terms